INVESTMENT OBJECTIVES & APPROACH

- Aiming to achieve superior long-term risk adjusted return

- Medium-term time horizon

- Investing primarily in equities and equity related securities of companies incorporated or having their principal business activities in Euroland

- Conviction investing using bottom-up stock-picking

- Flexible, opportunistic, and pragmatic approach, with no sector country bias and style/market cap agnostic

- Using a macroeconomic overlay to support sector positioning

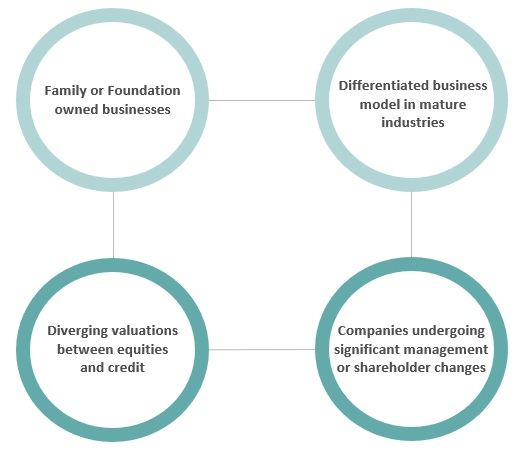

- Investment team focus on four strategic themes which provide a strong base for investment opportunities

Le compartiment investira principalement dans des actions européennes et titres assimilés selectionnés par le gérant. La valeur de la part du compartiment est susceptible de fluctuer de manière importante en fonction de différents facteurs liés à des changements propres aux entreprises représentées en portefeuille, des chiffres macro- économiques, de la législation juridique et fiscale.

Performances

Data as of 2026-01-08Track Record

Annuals Performances

| Performances from 2026-01-08 | NAV | YTD | 1 year | 3 years | Since inception | 2025 |

|---|---|---|---|---|---|---|

| ELEVA Euroland Selection R acc EUR | 224.75 € | +3.02 % | +26.73 % | +53.69 % | +124.75 % | +25.23 % |

| EURO STOXX Index (Net Return) | 1 438.42 | +2.12 % | +24.82 % | +55.72 % | +100.19 % | +24.25 % |

| Outperformance | - | + 0,90 | + 1,90 | -2,03 | + 24,56 | + 0,98 |

Characteristics

| Legal Type | - |

|---|---|

| Countries | BE, CH, DE, DK, GB, FI, FR, IE, IS, LU, NL, NO, PT, SE, SG |

| Custodian | BNP Paribas, Luxembourg |

| Management Fees | 0.9% TTC maximum |

| Subscription Fees | 3.0% TTC maximum |

| Redemption Fees | - |

| Recommended investment period | 5 ans |

| Life Insurance Eligibility | Yes |

| PEA Eligibility | Yes |

ELEVA Euroland Selection est (et restera) investi en permanence à hauteur de 75 % au moins en titres éligibles au PEA.

Performance scenarios (PRIIPS)

Available Shares

Performances from 2026-01-08| Share Name | ISIN Code | NAV | YTD | 2025 | 1 year | 3 years | Since inception | SRI | PRIIPs KID |

|---|---|---|---|---|---|---|---|---|---|

| ELEVA Euroland Selection - A2 acc EUR | LU1616921158 | 210.78 EUR | +2.99 % | +23.86 % | +25.34 % | +48.60 % | +110.78 % | 4/7 | |

| ELEVA Euroland Selection - A1 acc EUR | LU1616920697 | 208.17 EUR | +3.00 % | +24.51 % | +26.00 % | +50.88 % | +108.17 % | 4/7 | |

| ELEVA Euroland Selection - A1 dis. EUR | LU1616921075 | - | - | - | - | - | - | 4/7 | |

| ELEVA Euroland Selection - R acc EUR | LU1616922123 | 224.75 EUR | +3.02 % | +25.23 % | +26.73 % | +53.69 % | +124.75 % | 4/7 |

Past performance is not a guarantee of future results and no assurance can be given that capital initially invested will be preserved

The above is provided for information purposes only and is not intended to be investment advice. Past performance is no guarantee of future results. The impact of management fees on performance has been included. Access to the products and services presented here may be subject to restrictions with respect to certain individuals or countries. The tax treatment could vary on the situation of each. For further information on the structure and fees, please read this document in conjunction with the prospectus and relevant KIIDs which are available on this site or free of charge upon request from the registered office of the management company.