INVESTMENT OBJECTIVES & APPROACH

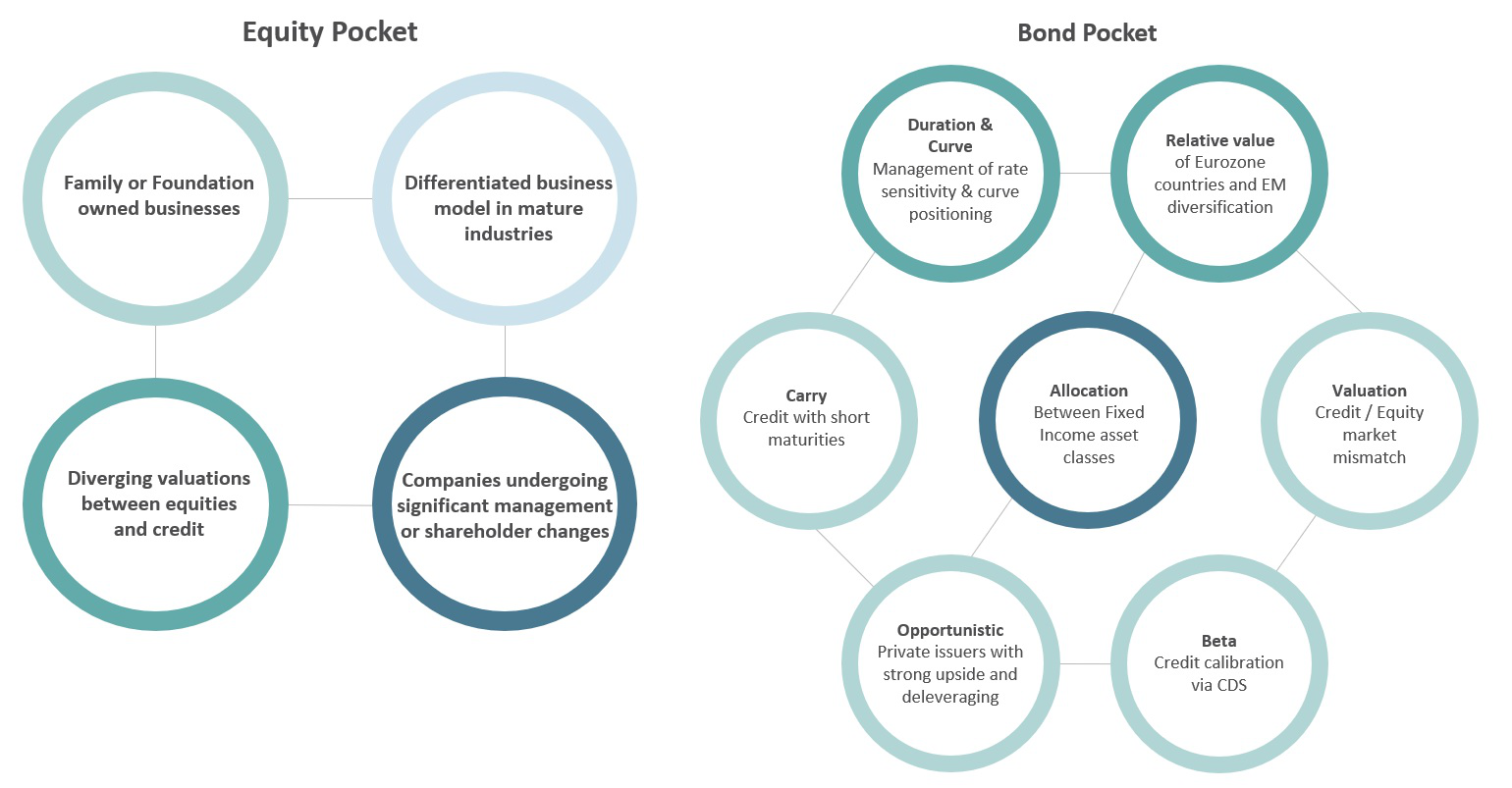

- The ELEVA Global Multi Opportunities Fund, which is a multi-asset sub-fund, seeks to achieve a positive absolute return over the medium term, mainly through active and flexible management of Global equities and equity related securities, and debt securities

- A dynamic allocation, totally flexible allocation from 0% to 100% in equities and debt

- Conviction-based and bottom-up approach complemented by a top-down analysis

- Equity: Flexible, opportunistic, and pragmatic approach, with no sector/country bias and style/market cap agnostic

- Fixed income: Total return approach with hedging of downside risk and duration comprised between 0 and 7 years

- Recommended investment period: 5 years

ELEVA Global Multi Opportunities suit une allocation diversifiée en investissant principalement dans des actions et titres assimilés à des actions de sociétés dont le siège social se situe en Europe, et dans des titres obligataires émis par des entités privées, publiques ou semi-publiques à l’echelle mondiale et principalement libellés en euro. La valeur de la part du compartiment est susceptible de fluctuer de manière importante en fonction de différents facteurs liés à des changements propres aux entreprises représentées en portefeuille, des chiffres macro- économiques, de la législation juridique et fiscale.

Performances

Data as of 2026-01-08Track Record

Annuals Performances

| Performances from 2026-01-08 | NAV | YTD | 1 year | 3 years | Since inception | 2025 |

|---|---|---|---|---|---|---|

| ELEVA Global Multi Opportunities A1 acc EUR | 127,81 € | +2,85 % | +13,94 % | - | +27,81 % | +11,77 % |

Characteristics

| Legal Type | - |

|---|---|

| Countries | AT, BE, CH, DE, GB, ES, FR, IE, LU, NL |

| Custodian | BNP Paribas, Luxembourg Branch |

| Management Fees | 2.0% TTC |

| Subscription Fees | 3.0% TTC maximum |

| - | - |

| Recommended investment period | 5 ans |

| Life Insurance Eligibility | No |

| PEA Eligibility | No |

Performance scenarios (PRIIPS)

Available Shares

Performances from 2026-01-08| Share Name | ISIN Code | NAV | YTD | 2025 | 1 year | 3 years | Since inception | SRI | PRIIPs KID |

|---|---|---|---|---|---|---|---|---|---|

| ELEVA Global Multi Opportunities - A2 acc EUR | LU2603203279 | 128.05 EUR | +2,84 % | +11,76 % | +13,90 % | - | +28,05 % | 3/7 | |

| ELEVA Global Multi Opportunities - A1 acc EUR | LU2598603699 | 127.81 EUR | +2,85 % | +11,77 % | +13,94 % | - | +27,81 % | 3/7 | |

| ELEVA Global Multi Opportunities - R acc EUR | LU2603204327 | 131.42 EUR | +2,86 % | +12,53 % | +14,69 % | - | +31,42 % | 3/7 |

Past performance is not a guarantee of future results and no assurance can be given that capital initially invested will be preserved

The above is provided for information purposes only and is not intended to be investment advice. Past performance is no guarantee of future results. The impact of management fees on performance has been included. Access to the products and services presented here may be subject to restrictions with respect to certain individuals or countries. The tax treatment could vary on the situation of each. For further information on the structure and fees, please read this document in conjunction with the prospectus and relevant KIIDs which are available on this site or free of charge upon request from the registered office of the management company.