INVESTMENT OBJECTIVES & APPROACH

- A multi-thematic strategy investing in listed European companies across all capitalizations and styles,

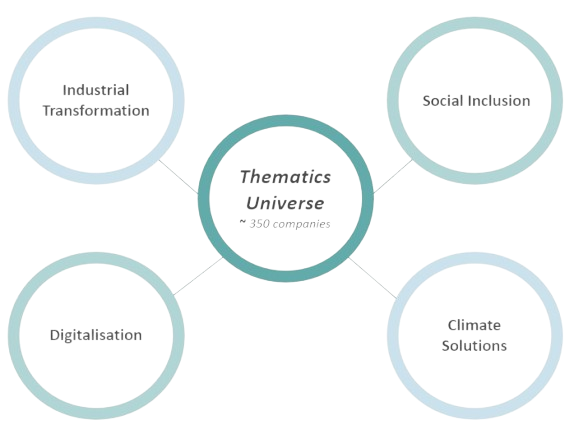

- A conviction actively managed strategy that selects sustainable, quality companies aligned with four major thematic pillars:

- Industrial Transformation

- Climate Solutions

- Social Inclusion

- Digitalisation

- 100% of the portfolio (excluding cash) is invested in sustainable companies, aligned with the UN Sustainable Development Goals and/or with credible climate strategies consistent with the Paris Agreement.

- The strategy uses the ELEVA Capital Index to guide portfolio construction.

- A recommended medium-term investment horizon.

Performances

For legal reasons, we can not post the performance of this share class

Characteristics

| Legal Type | - |

|---|---|

| Countries | LU |

| Custodian | BNP Paribas |

| Management Fees | 2.2% TTC |

| Subscription Fees | - |

| Redemption Fees | 3.0% TTC |

| Recommended investment period | - |

| Life Insurance Eligibility | No |

| PEA Eligibility | No |

Performance scenarios (PRIIPS)

Past performance is not a guarantee of future results and no assurance can be given that capital initially invested will be preserved

The above is provided for information purposes only and is not intended to be investment advice. Past performance is no guarantee of future results. The impact of management fees on performance has been included. Access to the products and services presented here may be subject to restrictions with respect to certain individuals or countries. The tax treatment could vary on the situation of each. For further information on the structure and fees, please read this document in conjunction with the prospectus and relevant KIIDs which are available on this site or free of charge upon request from the registered office of the management company.